Irish Invade Berlin for Buy-to-let Flats

One investor group has paid €40m and plans to splash out millions more.

Escaping mass unemployment at home in the Seventies and Eighties the Irish came to pull pints and serve the punters of West Berlin's bars and nightclubs. In the Nineties they flocked to the building sites to help reconstruct a reunified city after the Wall came down. Now in the 21st century they have come back. This time they are taking over Berlin.

At the far western end of the Kurfurstendamm - Berlin's well-heeled shopping district - lies the headquarters of the new Irish property invasion. In the last eight months alone, a group of Co Mayo investors has bought more than €40m worth of flats and apartments. At present they are negotiating a deal for a vast complex of apartments estimated to be worth €35m. Spearheading the big Irish buy-up of Berlin is Mike Morris from the Mayo-based Premier Estates Maloney. 'We started looking at Germany, and in particular Berlin, because it is a stable, conservative and trustworthy society,' he says. 'The company had thought about expanding our property portfolio into eastern Europe, but those countries are potentially unstable, which Germany is not,' he adds, as he surveys three apartment blocks that the company owns close to one of the main motorways looping around western Berlin. 'The €35m deal we are trying to secure now would land us with 900 apartments, 30 per cent of which need renovation. What we are offering in all our properties is a net return per annum of 7 per cent from rental incomes,' he says. Taking a brief stroll later across the Kurfurstendamm with Morris into the affluent Halensee district reveals the depth of the Irish investment invasion. As he passes by a row of businesses below ornate 19th-century Wilhelmine apartments along the Westfaelische Strasse, with shops ranging from health food centres to lingerie stores, Morris points and says: 'That's Irish-owned, that's Irish-owned and that's Irish-owned. In fact most of the buildings on this side of the street have Irish landowners.' Premier Estates Maloney and the other Irish companies following in their wake have not kept their investments solely to western Berlin. Their portfolio includes apartment blocks in the eastern and increasingly fashionable Prenzlauer Berg district. These include six retail units and 15 offices, with a branch of McDonald's as the main tenant. The expansion eastwards of the Irish investor follows a trend across Europe with entrepreneurs who made fortunes from the growth of the Celtic tiger economy buying up airports and shopping malls in England; thousands of apartments on the Spanish Costas and Florida; and hotels and ski chalets in the Balkans. The Irish are estimated to be in the top three foreign investor nations in Berlin. However, in a city of 3.4 million, where only half of its citizens are working, German observers of the Berlin property market are extremely cautious. Ralf Schoenball, a property expert for the Berlin-based daily Der Tagesspiegel, warns that Berlin may not be the best place for Irish investors to buy flats and apartments. 'Don't get me wrong here. I have been here since 1983 and I love Berlin. But the economy of this city has shrunk every year since 1996 with one exception: [growth of] 1 per cent in 2000. 'Because of the shrinking economy there are fewer Berliners working and the incomes of the households are decreasing if you take into account the cost of living. For the housing market this means that, as people have less money, an increase in rents makes it harder for them to pay. There are also 100,000 empty flats in Berlin, so tenants can move around and find the cheapest places to rent.' Morris brushes aside the cautious noises of German observers and says: 'The prospects for Berlin look good in the long run. Many of the Germans in business here are too conservative. 'There are good deals to be had here in Berlin and the long-term returns will be worth it. We might take a look at Dresden too.'

By Guardian Unlimited © Copyright Guardian Newspapers 2006Published: 9/2/2006

Welcome to Germany

Germany is looking likely to turn into one of the hottest property markets in Europe after 10 years of static prices. Germany is a new market for most overseas investors and it will take time for it to develop. Growth is starting in cities such as Berlin now that unemployment is beginning to drop and interest in home ownership is beginning to increase.

Under 40% of Germans own their own homes compared with around 80% in the UK and Ireland. In Berlin this figure is just 14%. When the German market awakens to the opportunity of property investment with low interest rates and their economy starts to recover again we are expecting to see significant price rises over the next 5-7 years from a very low starting point today. For example prices in Berlin, one of Europe's major cities, are at €1,000 - €3,000 per square metre in many excellent areas compared to prices of €10,000+ per square metre in Paris, London and other major capital cities.

The Government has moved from Bonn to Berlin and the quality of the city and its architecture has to be seen to be believed. However, until the residents start to see the value of buying their own homes and rents start to rise through greater professional overseas landlord ownership and management prices will remain static. Fortunately huge multi-billion euro investments have been made by UK and US funds in the last year or so and in 2006 we believe that this change is beginning now and the growth has started.

German Press on Real Estate.

Real Estate

Before the wall came down, Berlin enjoyed a privileged status which attracted numerous subsidies. This affected rents and house prices too - both West and East Berliners were encouraged to stay in the city, and subsidised housing was one of the incentives.Since the fall of the wall there has been something of a building boom. Western companies were again encouraged to build, invest and refurbish in Berlin with a number of government subsidies and tax incentives, which are gradually being phased out.Some construction projects have proven over-ambitious as exclusive office spaces and apartment buildings remain empty. Rents and house prices are still relatively cheap in Berlin, particularly compared to Hamburg, Munich and other cities in the West, where rents can be twice or three times as expensive for equal space. With the mass government relocation from Bonn, rises in real estates prices were predicted, but so far the impact has been minimal.

Germany is looking likely to turn into one of the hottest property markets in Europe after 10 years of static prices. Germany is a new market for most overseas investors and it will take time for it to develop. Growth is starting in cities such as Berlin now that unemployment is beginning to drop and interest in home ownership is beginning to increase.

Under 40% of Germans own their own homes compared with around 80% in the UK and Ireland. In Berlin this figure is just 14%. When the German market awakens to the opportunity of property investment with low interest rates and their economy starts to recover again we are expecting to see significant price rises over the next 5-7 years from a very low starting point today. For example prices in Berlin, one of Europe's major cities, are at €1,000 - €3,000 per square metre in many excellent areas compared to prices of €10,000+ per square metre in Paris, London and other major capital cities.

The Government has moved from Bonn to Berlin and the quality of the city and its architecture has to be seen to be believed. However, until the residents start to see the value of buying their own homes and rents start to rise through greater professional overseas landlord ownership and management prices will remain static. Fortunately huge multi-billion euro investments have been made by UK and US funds in the last year or so and in 2006 we believe that this change is beginning now and the growth has started.

This is still a renters market, and renting is not seen as being socially inferior to buying property - people who can easily afford to buy property do not always do so, as renting is a great value.However, should you wish to buy property, there are several factors to consider which may differ from your home country.1) The size of property is always measured not in bedrooms, but in square metres (m²), which may at first seem baffling if your idea of large is a house with 5 bedrooms.2) The number of rooms quoted generally does not include kitchen and bathroom. Reception rooms and bedrooms are usually all counted as 'rooms'.3) There is less of a variety of housing in Berlin - as with most European cities, the vast majority of dwellings are flats. Detached houses are generally found on the outskirts of the city and tend to be exclusive and pricey.

Brits snap up Berlin homes

Evening Standard16 January 2007

Britons are flocking to Berlin as a resurgent German economy makes Europe's cheapest metropolis attractive to second-home buyers.

Brits, Irish and Americans last year spent £7bn on properties in the German capital.

Much of the spend was by institutional investors but private individuals are buying hundreds of flats. Investors have also come from Spain, Norway, Sweden and France.

Big flats in trendy areas can cost as little as £110,000.

Move slightly out and that can drop to between £70,000 and £90,000. Jurgen Michael Schick, vice president of Germany's IVD Real Estate Association, said more than €10bn(£6.6bn) was spent on Berlin properties in 2006, with 'foreign investors accounting for most of those transactions'.

Philipp Tabert, head of Berlin real estate consultancy Winters & Hirsch, said: 'Values are significantly lower than those in London, New York or even Prague and Moscow.' Almost 95% of Tabert's clients are from Britain, Ireland, America, Spain, Italy and France.

Berlin property prices dropped every year from 1996 to 2004 while in London they climbed 80%.

A renovated flat in a prime Berlin area can today cost €1,500 a square metre while one in London is €15,000.

Gary Savage, a teacher from London, said his 87-square-metre apartment in the heart of the Mitte district, for which he paid €145,000, was a real bargain.

'You couldn't even buy a garage or a shed in London today for that,' he said.

Private equity funds such as New York-based Cerberus Capital Management and Goldman Sachs' Whitehall investment fund have also been targeting Berlin. In 2004, the two together bought 65,700 units of Berlin public housing for €2.1bn.

Should you buy in Germany?

David Allsop, Daily Mail7 July 2006Surprisingly, though, despite its proximity and value for money, it barely features on the wish list of British buyers of holiday homes.

There are a number of reasons for this, but one of the most obvious is that Germany is not a major tourist draw for British holidaymakers or second home owners.

Most of us buy property abroad to let it out to other British holidaymakers or to live in communities of fellow expatriates.

Neither really applies to Germany, but the focus on the country during the World Cup could be about to change all that.

Savvy property investors are talking about Germany being the next big thing on the Continent. But on what grounds?

According to the European Housing Review 2006, it is the only European country where residential property prices dropped last year.

In its recent report, property analyst Merrill Lynch observed that the country 'has conspicuously failed to join in the global housing boom of the past ten years'.

A number of factors have contributed towards this curious anomaly in an otherwise upward Continental trend.

Low levels of home ownership (42% compared with 70% in Britain), a culture of state subsidy for rental accommodation and reluctance by German banks to lend money to buy property have combined to cause house prices to stagnate.

So, yes, Germany could be a good place to invest: you will be buying close to the bottom of a market which is expected to go up.

CELEBRATION TIME: The Brandenburg Gate has been a focal point for World Cup celebrations and Berlin could be a good property investment

'The German property market has underperformed for a long time,' confirms Liam Bailey, head of residential research at Knight Frank. 'But there's been a lot of interest in Germany recently, led by major institutions and banks who can sniff a profit.

'It's one of the few markets where property investors can still pick up big chunks of stock very cheaply. The residential property market does offer value.'

Ilya Spitalnik, of German Property Investors, is more exuberant. 'It's a fantastic place to invest,' he declares. 'Eighteen months ago, the market had bottomed out. But it has now increased by at least 15% - in some areas, far more than that.'

If this rapid recovery suggests that new investors may have missed the boat, Mr Spitalnik thinks otherwise.

'In practice, although German property prices are going up, it is still excellent value compared with other European countries,' he says.

skip to main |

skip to sidebar

I represent many agencies, developers, investors, companies who wish to sell the German Properties. Apartments ( Vacant & Tenanted), Tenanted blocks ( Residential & Commercial), Care Homes, Hotels, Land, Shopping Centres, leaseback, off plan. If German property investment interests you please register with me now on harrisonandcohn@gmail.com and view a selection on http://www.harrisonstone.co.uk/prop_list.asp?CountryID=35

CONCIERGE.COM: LATEST TRAVEL FEATURES

Blog Archive

About Me

Boom Time Bavaria

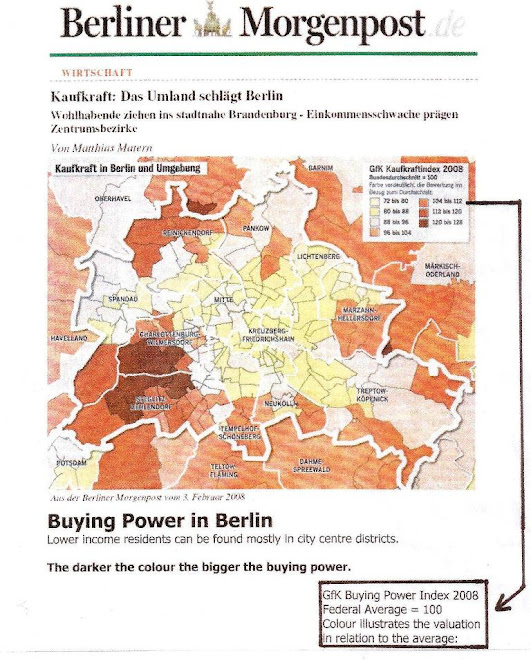

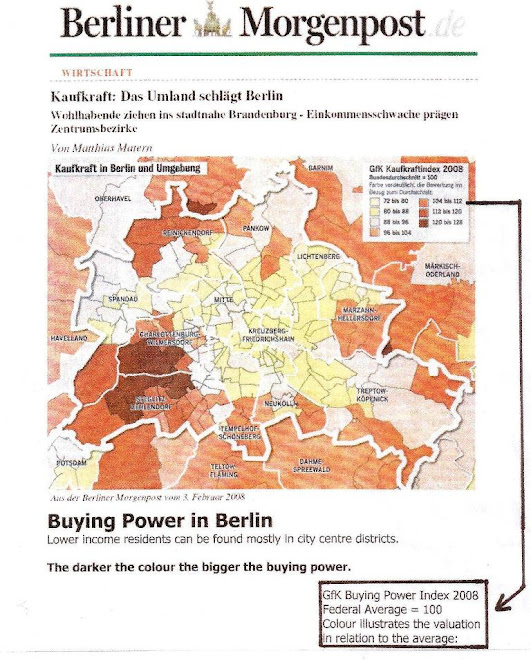

Berliner Morgenpost Extract