From Adam at Harrison & Cohn,

harrisonandcohn@googlemail.com

www.harrisonstone.co.uk

German Companies Barely Hit by Financial Market Woes, KfW Says

July 3 (Bloomberg) -- German companies have been barely affected by the financial market crisis that resulted from the collapse of the U.S. subprime mortgage market, KfW Group said, citing a survey it conducted with business lobbies.

Sixty-two percent of companies said the availability of credit hasn't changed, the government-owned development bank said today. The share of companies that reported more difficulty in getting loans rose to 27 percent from 25 percent a year ago, while 12 percent said it's easier to get financing, down from 14 percent. ``Concerns that the financial market crisis has significantly worsened the financing conditions in Germany, and is spilling over into the real economy, so far haven't materialized,'' KfW Chief Economist Norbert Irsch said in a prepared statement. ``The availability of credit hasn't become much worse and so far there are no signs of a credit squeeze.''

German non-financial companies are weathering the fallout from the U.S. subprime mortgage crisis because they rely less than others on external financing. The German economy is in ``robust'' shape, Finance Minister Peer Steinbrueck has said, and may expand more than 2 percent this year, according to forecasts by the country's leading economic institutes.

KfW, the BDI federation of German industry, the BGA employers' association, the HDE retailers' lobby and the ZDH association of skilled trades together surveyed around 5,000 companies in the first quarter of this year.

The world's biggest financial companies have posted almost $400 billion in writedowns and credit losses since the start of last year after the collapse of the U.S. market for subprime mortgages, aimed at people with poor credit histories.

KfW Group led bailouts in Dusseldorf-based IKB Deutsche Industriebank AG that cost more than 8 billion euros ($12.4 billion). IKB became the first German casualty of the subprime collapse last year after its finance affiliate couldn't raise funding amid the credit crunch.

Source: Bloomberg (03 July 08)

skip to main |

skip to sidebar

I represent many agencies, developers, investors, companies who wish to sell the German Properties. Apartments ( Vacant & Tenanted), Tenanted blocks ( Residential & Commercial), Care Homes, Hotels, Land, Shopping Centres, leaseback, off plan. If German property investment interests you please register with me now on harrisonandcohn@gmail.com and view a selection on http://www.harrisonstone.co.uk/prop_list.asp?CountryID=35

CONCIERGE.COM: LATEST TRAVEL FEATURES

About Me

Boom Time Bavaria

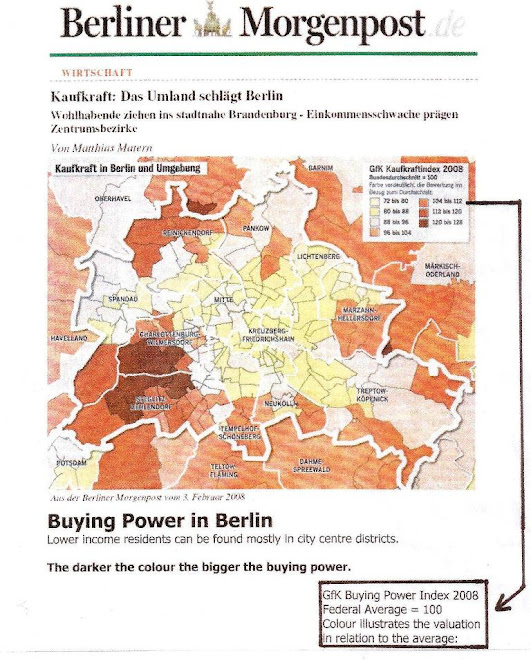

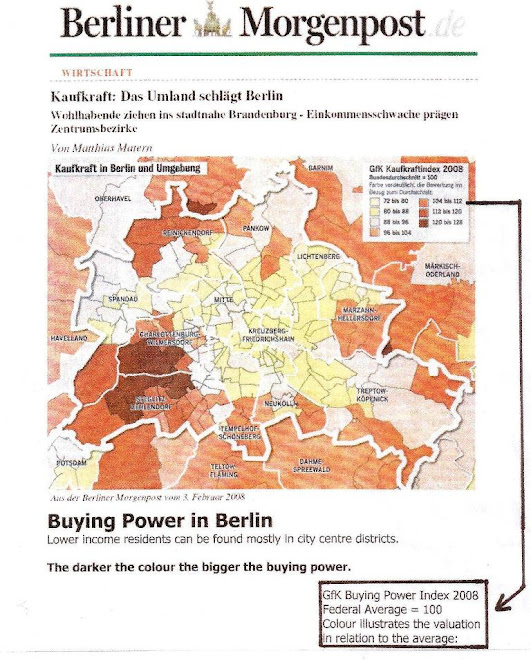

Berliner Morgenpost Extract